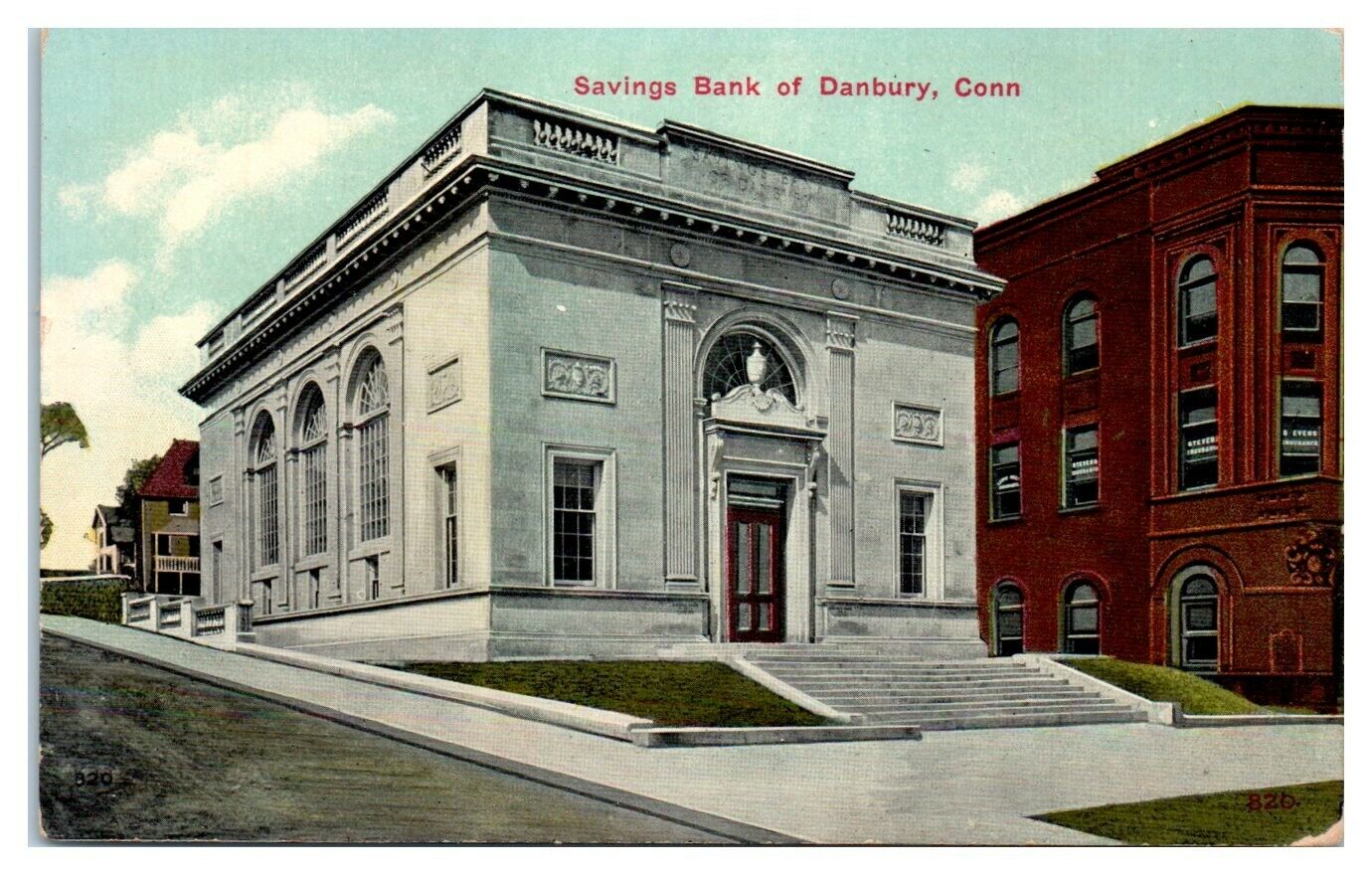

The Savings bank of Danbury: A Deep Dive

The Savings Bank of Danbury, now known as Ives Bank, is a prominent financial institution with a rich history deeply intertwined with the community it serves. Founded in 1849, the bank has evolved from its humble beginnings to become a significant player in the Connecticut banking landscape, offering a comprehensive range of financial products and services to individuals and businesses alike.

A Glimpse into the Past: Early Years and Growth

The bank’s journey began in the heart of Danbury, Connecticut, during a time of economic growth and development. Recognizing the need for a reliable and trustworthy financial institution within the community, a group of visionaries established the Savings Bank of Danbury. The bank’s early focus was on providing essential banking services to local residents, fostering a strong sense of community trust and support.

Over the decades, the Savings Bank of Danbury experienced steady growth, expanding its services and expanding its reach to serve a wider clientele. The bank diligently adapted to the evolving needs of its customers, introducing new products and services to meet the changing financial landscape. This commitment to innovation and customer satisfaction has been a cornerstone of the bank’s enduring success.

A Commitment to Community: Philanthropy and Local Involvement

Beyond its core banking functions, the Savings Bank of Danbury has consistently demonstrated a strong commitment to supporting the communities it serves. The bank has a long-standing tradition of philanthropic giving, actively contributing to various charitable organizations and community initiatives. This dedication to social responsibility has earned the bank a reputation as a valued partner in the economic and social well-being of the region.

A Modern Approach: Products and Services

Today, Ives Bank offers a comprehensive suite of financial products and services designed to meet the diverse needs of its customers. These offerings include:

Checking and Savings Accounts: A variety of checking and savings accounts tailored to different needs and financial goals, including high-yield savings accounts and money market accounts.

A Focus on Customer Experience: Innovation and Technology

Ives Bank recognizes the importance of providing a seamless and convenient customer experience in today’s digital age. The bank has invested heavily in technology to enhance its service offerings and improve customer satisfaction. This includes:

Digital Banking Platforms: User-friendly online and mobile banking platforms that provide customers with access to their accounts, make transactions, and manage their finances with ease.

A Strong Foundation for the Future: Financial Stability and Growth

Ives Bank has a strong track record of financial stability and growth. The bank maintains a solid capital base and has consistently demonstrated sound financial performance. This strong foundation provides a solid platform for continued growth and expansion in the years to come.

Looking Ahead: Challenges and Opportunities

Like any financial institution, Ives Bank faces a number of challenges in the evolving financial landscape. These include:

Competition: Increasing competition from larger banks and online financial institutions.

However, Ives Bank also possesses several key strengths that position it for continued success:

Strong Community Roots: Deep-rooted connections within the communities it serves, fostering strong customer loyalty.

By leveraging its strengths and effectively addressing the challenges it faces, Ives Bank is poised to continue its success as a leading financial institution in Connecticut for many years to come.

` and `

` tags for improved readability and structure.

bank of danbury