Lohr’s Orchard HOA Bill Pay: A Comprehensive Guide

The Lohr’s Orchard Homeowners Association (HOA) plays a vital role in maintaining the community’s aesthetic appeal, safety, and overall quality of life. As a homeowner within the community, understanding your HOA dues and how to pay them efficiently is crucial. This article provides a comprehensive guide to Lohr’s Orchard HOA bill pay, covering various payment methods, important deadlines, and frequently asked questions.

HOA dues are typically assessed on a monthly or quarterly basis. These fees contribute to the upkeep of common areas within the community, such as:

Landscaping and Grounds Maintenance: Maintaining well-manicured lawns, trimming trees and shrubs, and ensuring the cleanliness of common areas.

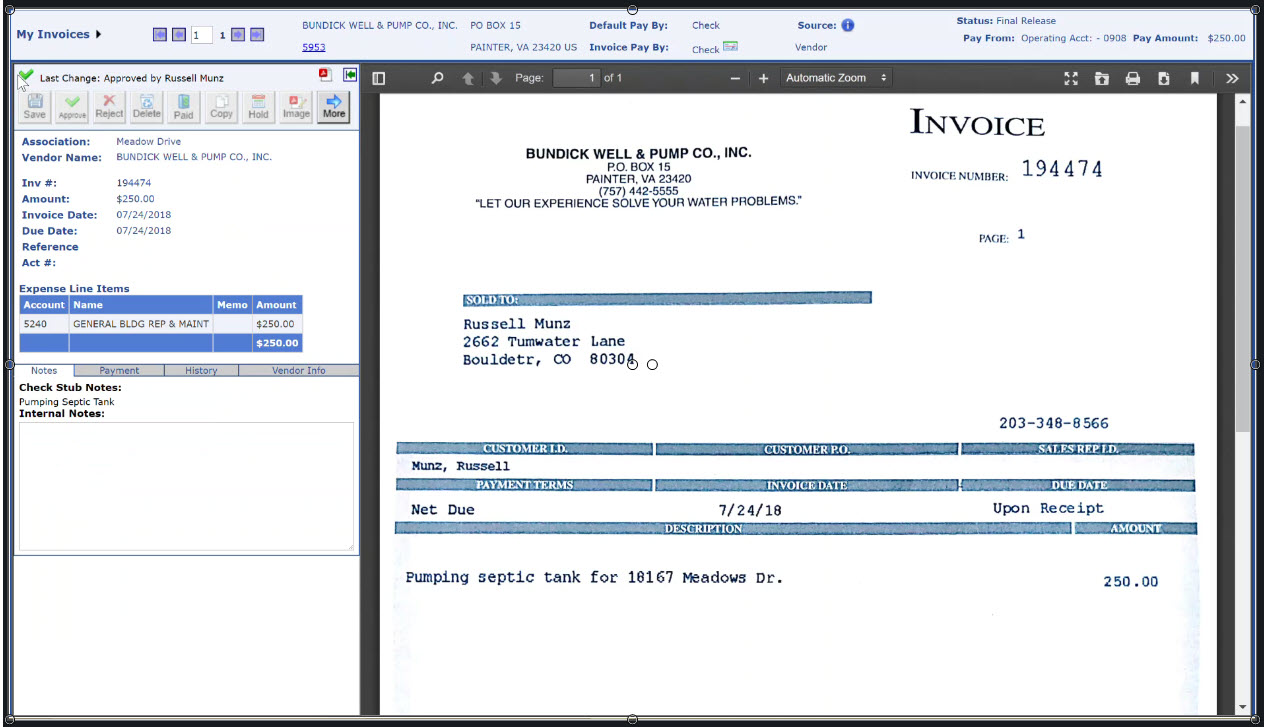

The Lohr’s Orchard HOA likely offers a variety of convenient payment methods for homeowners. These may include:

Convenience: Online portals offer the most convenient option, allowing homeowners to make payments 24/7 from any internet-connected device.

Traditional Method: Homeowners can mail their payments to the designated address provided by the HOA.

Limited Availability: In-person payments may be accepted at a designated location, such as the HOA office or a local bank.

Direct Debit: Homeowners can authorize the HOA to directly debit their bank account on the due date.

Due Date: Familiarize yourself with the HOA’s due date for monthly or quarterly dues. Late payments may incur late fees or penalties.

Consequences: Late payments can result in late fees or penalties. These fees can vary depending on the HOA’s governing documents.

Questions: If you have any questions regarding your HOA dues, payment methods, or any other HOA-related matters, contact the HOA management.

What happens if I cannot afford to pay my HOA dues?

By understanding your HOA dues, exploring available payment options, and adhering to important deadlines, you can ensure timely and hassle-free payments to the Lohr’s Orchard HOA. This not only helps maintain the community’s financial stability but also contributes to a more enjoyable living experience for all residents.

This article is intended for informational purposes only and should not be construed as legal or financial advice. It is crucial to consult with the Lohr’s Orchard HOA directly for the most accurate and up-to-date information regarding dues, payment methods, and any applicable rules and regulations.

The information provided in this article may be subject to change. It is recommended to regularly review the HOA’s official website or contact the HOA management for any updates or modifications to policies and procedures.

lohr orchard hoa bill pay