bank Realization Certificate: A Comprehensive Guide

A Bank Realization Certificate (BRC) is a crucial document in international trade, particularly for exporters. It serves as proof that the exporter has received payment for goods or services exported from their country. This certificate is issued by the exporter’s bank and is essential for claiming various export incentives and benefits offered by governments. This article delves into the intricacies of BRCs, covering their purpose, importance, process of obtaining them, and related aspects.

What is a Bank Realization Certificate?

A BRC is a formal statement from a bank confirming the receipt of export proceeds in a specific currency. It details the transaction, including the exporter’s name, the importer’s name, the invoice number, the date of realization, the amount realized, and the currency of realization. Essentially, it acts as concrete evidence that the exporter has been paid for their export.

Importance of a Bank Realization Certificate

BRCs hold significant importance for exporters for several reasons:

Claiming Export Incentives: Governments often provide various incentives to boost exports, such as duty drawbacks, tax exemptions, and Merchandise Exports from India Scheme (MEIS) benefits. A BRC is a mandatory document for claiming these benefits, as it substantiates the export transaction and receipt of payment.

Process of Obtaining a Bank Realization Certificate

The process of obtaining a BRC is generally straightforward:

1. Export of Goods/Services: The exporter first completes the export transaction by shipping the goods or providing the services to the importer.

2. Receipt of Payment: The importer remits the payment to the exporter through banking channels, typically via wire transfer or letter of credit.

3. Request to Bank: Once the payment is credited to the exporter’s account, they can request their bank to issue a BRC.

4. Submission of Documents: The exporter needs to submit certain documents to the bank, including:

5. Issuance of BRC: After verifying the documents and confirming the receipt of funds, the bank issues the BRC to the exporter.

Key Details Included in a Bank Realization Certificate

A typical BRC contains the following essential information:

Exporter’s Name and Address: The legal name and registered address of the exporting entity.

Importance of Accurate Information on BRCs

Accuracy is paramount when it comes to the information provided on a BRC. Any discrepancies or errors can lead to delays in claiming export benefits, compliance issues, or even legal complications. Exporters must ensure that all details on the BRC match the corresponding export documents.

Common Issues and Challenges Related to BRCs

While the process of obtaining a BRC is generally smooth, certain issues can arise:

Delays in Issuance: Sometimes, banks may take longer than expected to issue BRCs due to internal procedures or documentation issues.

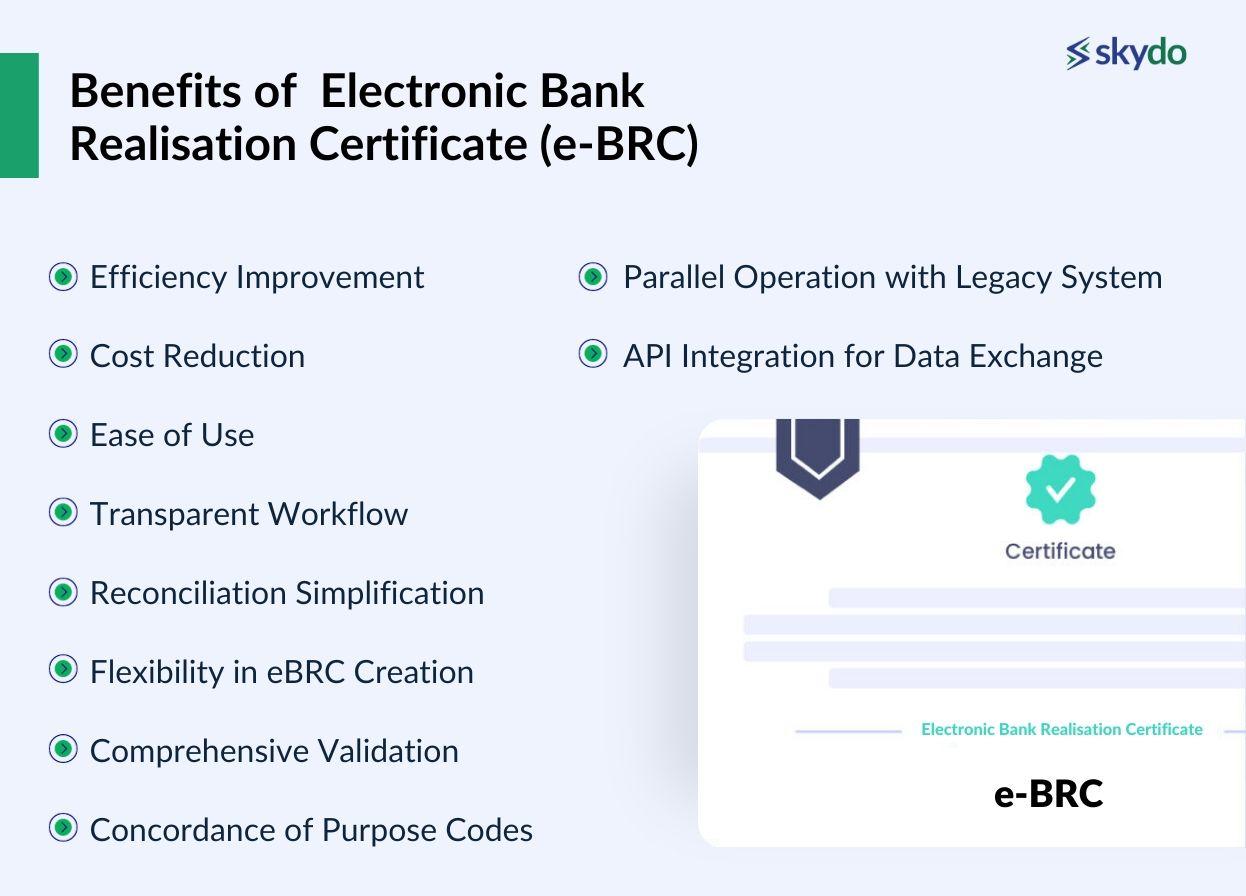

Digitalization of BRCs

Many countries are moving towards the digitalization of trade documents, including BRCs. Electronic BRCs offer several advantages, such as faster processing, reduced paperwork, and improved security. This shift towards digitalization is expected to further streamline international trade processes.

Conclusion

The Bank Realization Certificate is a vital document for exporters, serving as proof of payment and enabling them to claim export incentives and comply with regulatory requirements. Understanding the importance, process, and related aspects of BRCs is crucial for exporters to effectively manage their international trade operations and maximize their benefits. By ensuring accuracy and maintaining proper records, exporters can leverage BRCs to facilitate smooth and successful export transactions.

bank realization certificate